SoulBrandingSM:

SoulBrandingSM:

An interview with Elsie Maio

AIGA, GAIN Conference BEYOND BRANDING

2003, USA

Interview by David Womack

Elsie Maio is the founder and president of Maio and Company, Inc. She began her career on Wall Street in equities research and was a senior editor at Institutional Investor before joining McKinsey & Company. Inspired by the potential for disciplined strategic communications to move business forward, she became a senior partner at several world-class identity firms. In 1994, she founded Maio and Company to focus on helping clients achieve hard business results through the soft science of brand and identity management. Her opinions appear in The Wall Street Journal, Institutional Investor, Brandweek, Brand Marketing and American Banker, as well as in leading European business publications. She also provides marketing commentary for National Public Radio's “Marketplace News.”

GAIN: Although many of the issues you champion are often lumped together under "sustainability," you are resistant to term. Why?

MAIO: The term "sustainability" can be misleading. When company talks about its commitment to sustainability, what they really mean? Self-preservation? Environmental sensitivity? Or do they mean a broad social contract with humanity? That ambiguity is confusing. And the last thing business wants these days is confuse already skeptical stakeholders. At worst, the term suggests that "endurance" or the status quo are worthy corporate goals. But our research points to growing pressure for a new paradigm. For the engine of business to its momentum toward enhancing life on earth in a profitable, moral manner that focuses its extraordinary ingenuity and passion for profitable growth on inventing the next generation of win/win solutions. Yes, "sustainability" is necessary but just not enough.

GAIN: Why is the need for this change particularly acute today?

MAIO: Historically, the seeds of this larger role have sprung in the face of tragedy and moral outrage. For instance, the Triangle factory fire of 1911 led to new regulations that made businesses responsible for the safety of employees. Now, our recent scandals, there is again a call for greater ethics business. What we see in our institutions is a process of decay and of systemic breakdown. Corporations have been grant the privileges of personhood under the law of the U.S. but haven't been given the responsibilities. We, as a society, are beginning to hold them responsible. As businesses become larger parts of our lives they are going to have to address questions. This is not just a social or environmental necessity. Recent scandals have shown that businesses that are not ethically sound are not financially stable.

GAIN: Why does it seem that businesses are now more vulnerable to scandals?

MAIO: Stakeholders can see the intent of the company more readily now. It used to be that the messages of advertising PR would dictate impressions of a company. Today, the pattern of its actions shows the corporation's main premise. How? The internet has empowered consumers to observe corporate behavior much more closely. Communities of interest now a way to connect instantaneously to companies and to each other, regardless of how many shares they hold or where are located geographically. This is a new ability for consumers and small shareholders, who in the past may have felt powerless to understand business, much less effect change. Technology has made business more transparent, visible and vulnerable. There's no place for businesses to hide.

GAIN: Can you give us an example of the effects of this new transparency?

MAIO: Take Monsanto. Monsanto had a visionary CEO and extraordinary people inside managing that branding practice. They had excellent professional design support and they had fabulous creative team. It was inspiring. I was impressed what they did but the world wasn't. Monsanto failed to take to account how visible their products had become and how strongly certain consumers felt about having genetically modified organisms in the agricultural system. As a result they went into Europe they were shouted down time and again. The backlash for Monsanto basically dismantled the company. So I say that, from a creative, brand design perspective, the brand operation was a total success, but that patient died. Old branding process forgot key stakeholders. This was a sad because that company’s intent, I believe, was truly to prove "food, health, and hope" to the world’s populations.

GAIN: Have branding practices contributed to the current crisis?

MAIO: When I look at the branding discipline, I see a set of behaviors and objectives that are no longer sufficient. For companies to think that they can improve their positioning simply through increasing communication is just making them more and more vulnerable. BP, for example, has redefined themselves as a company that cares about people and the environment. This repositioning has opened up broader opportunities for them. But they have also made themselves very vulnerable. Any prime mover is a target, especially in what has been termed the "greater good marketplace."

GAIN: Usually what problems do businesses bring to you?

MAIO: The businesses that come to us for help are usually in the process of expansion. They are raising their profile. As they step up into the spotlight, the leadership needs to be confident that their act is clean. Often these companies have been driven by a single personality or set of personalities and now need to institutionalize their value system. In order to step up into the spotlight, the leadership needs to have a reality check on ethical and environmental risks and a viable plan for improving current shortcomings. Others clients come seeking to gain a broader strategic value from specific ethical practices. Our clients come to recognize that the promise of their brand, no matter how creatively scintillating, is a liability unless they deliver it in the spirit of mutual benefit to their communities.

GAIN: So how do you help business create an effective value system?

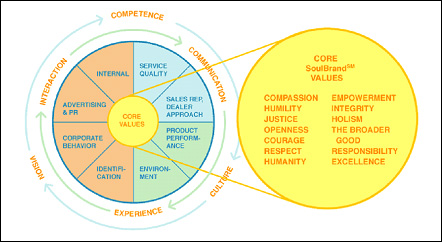

MAIO: It has to happen from the inside out. Really, it is more a process of discovery than creation. The values are there. They live in the people who work for the company. What we try to do is to provide a voice and a framework for inputting these values into the decision-making process. One of the first steps is a self audit. Employees identify what their core motivating values are. They rate each aspect of the company separately, creating a kind of report card. We then ask the employees where they think the company should rate. The results vary from industry to industry and from level to level within the company. We then ask the employees what specific evidence the employees would need to be convinced that the company had actually improved. So, in the end, what management gets is a detailed report card, a set of goals and a snapshot of milestones of credibility.

GAIN: I can see why this approach might make for happy employees, but is this kind of rule-by-consensus effective for generating business value?

MAIO: Not only are we factoring in employee's inputs, but strategic external stakeholders' input too. The transparency of corporate behavior is a fact of life now. It is changing brand management from a directive to a participatory process. And the solutions are richer for it. The leverage for management is potentially huge. Of course, consensus is not the only factor in determining the direction a business should take, but it is important. More and more I see strategists coming together around the idea of participation and inclusiveness. Studies show that business leaders make better decisions when they have more inputs. This is contrary to the whole expert setup. What we're seeing in business today is, to borrow a phrase I have been hearing a lot lately, "the fall of the house of experts." Decisions that come from within are richer and more efficient than expert-driven points of view.

GAIN: We have been talking a lot about the responsibilities of business, what about the responsibilities of shareholders and consumers?

MAIO: The Dow Jones sustainability group index was started in 1999 to track companies that manage themselves in a more balanced way. How did they determine which businesses were balanced and sustainable? The first cut-off was a 10-year planning horizon. Investors have been pushing CEOs to drive up stock prices by doing what is expedient in the short term. So how can we blame the CEOs? This is what they are rewarded for. You can't run a sound, balanced, responsible business quarter to quarter. You are going to win some profit quarters and lose some. The greater good is the responsibility of each investor and consumer. We need to look at our own motivations and our own greed. Businesses, by and large, are jumping through the hoops that we set.

Published March 6, 2003